SHARE

READ & LEAVE A COMMENT

Capital One recently conducted a Millennial Mindset on Money Survey to learn more about how Millennials tackle the highs and lows of post college finance. The survey reveals Millennials’ attitudes on spending, saving and sharing amongst adults ages 21-29.

For those people out there who say, “talking about money and finances could NEVER be fun”…. Well we certainly proved them wrong! Last week’s rapid-fire chatter proved that this generation is hungry for success and we are pioneering our own path to achieve financial independence. Last week’s #MillennialTalk Twitter Chat was inspired by the survey findings.

If you missed our chat…not to fear! See the Highlights below.

Q1: How do you currently feel about your money and finances? #MillennialTalk

A Capital One survey revealed: When asked to choose their top two financial goals, Millennials made it clear that “Not living paycheck to paycheck” is one of the most important to achieve with 55% choosing that as a top goal.

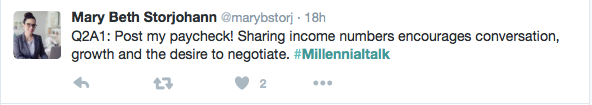

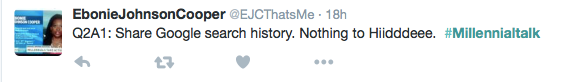

Q2. Let’s play would you rather…would you rather post a photo of your paycheck on Instagram or share your Google search history on Facebook? #MillennialTalk

A Capital One survey revealed: 58% of Millennials say they would rather post a photo of their paycheck on Instagram than share their Google search history on Facebook (42%).

Q3. Although Millennials have time, what should we be doing NOW to make our retirement most rewarding?

Q3. Although Millennials have time, what should we be doing NOW to make our retirement most rewarding?

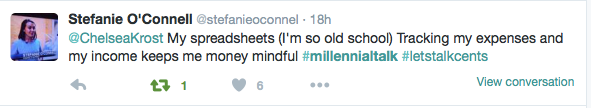

Q4: What technology innovation(s) helps you most with organizing your finances? #MillennialTalk

Q5. When it comes to negotiating your salary what are some tips to approach the subject to score a larger paycheck? #MillennialTalk

Q5. When it comes to negotiating your salary what are some tips to approach the subject to score a larger paycheck? #MillennialTalk

Q6. Any tips can you share about maintaining or improving your credit score? #MillennialTalk

Q7.Do you have any advice for organizing an emergency savings? #MillennialTalk

Q8. What is some of the best advice you’ve received to make managing your 401(k) plan simple and effective? #MillennialTalk

Q8. What is some of the best advice you’ve received to make managing your 401(k) plan simple and effective? #MillennialTalk

Q9. For those of us in debt, what are some steps for how we can create a strategy plan that helps to pay it off quickly? #MillennialTalk

Q9. For those of us in debt, what are some steps for how we can create a strategy plan that helps to pay it off quickly? #MillennialTalk

Q10. For all the young couples out there, what are some tips when it comes to joint finances? #MillennialTalk

Thank you Capital One for helping make this week’s Twitter Chat and Blab loaded with knowledgeable influencers who provided great financial, career, and life tips!

If you’re interested in learning more about Millennials’ attitudes on spending, saving, and sharing, check out the results of the Capital One survey here: Millennial Mindset on Money Survey.

SHARE

READ & LEAVE A COMMENT