SHARE

READ & LEAVE A COMMENT

By: Chelsea Krost

Millennials are true digital natives, always quick to pioneer and implement new trends in technology into their daily lives. That’s why I’ve partnered with the social payment app Circle to create the Young Money Guide to highlight the changing relationship between Millennials and their finances. Between new cutting-edge tech tools and good ‘ol fashion finance know-how, this guide is your ticket to financial success.

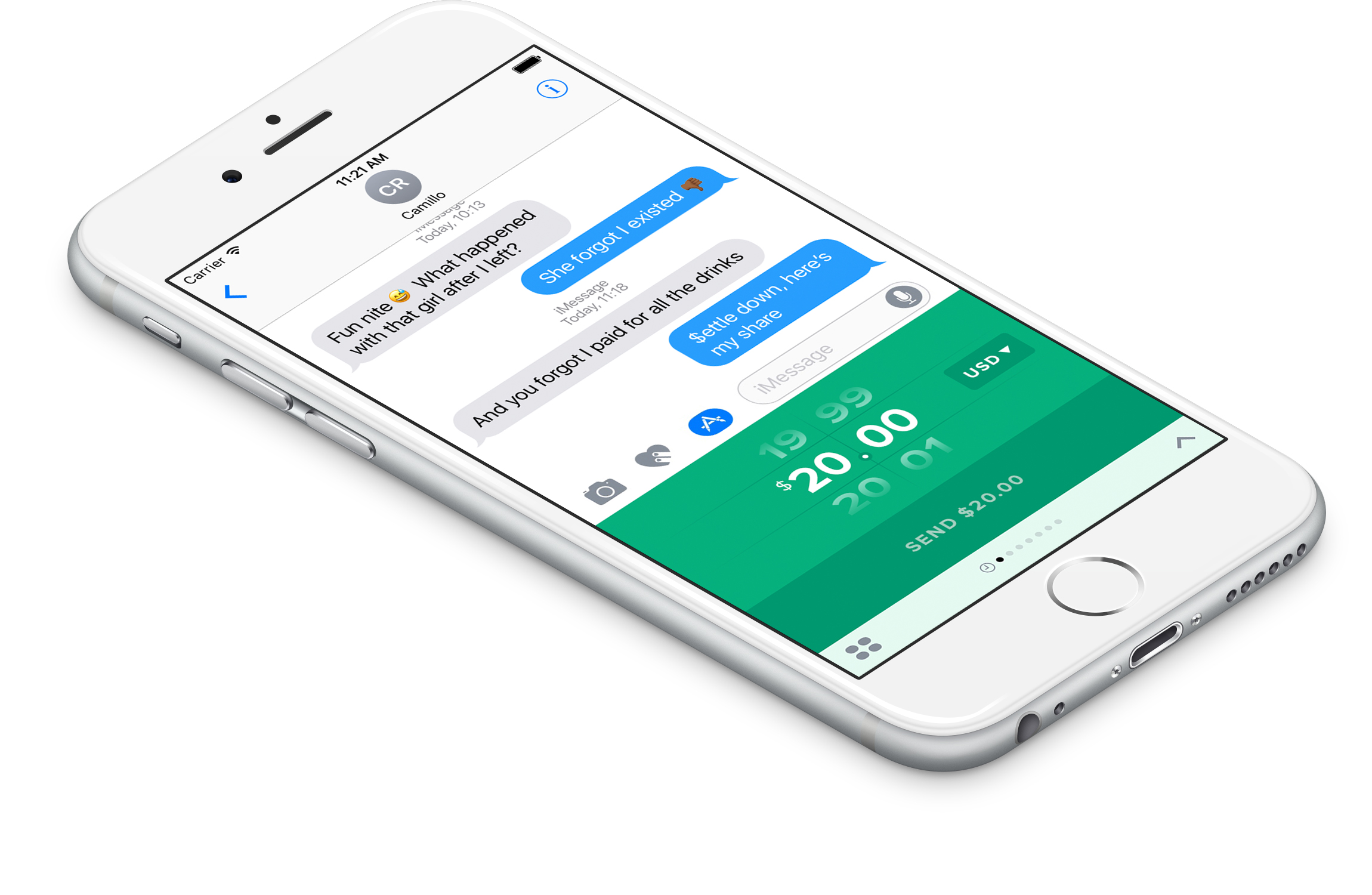

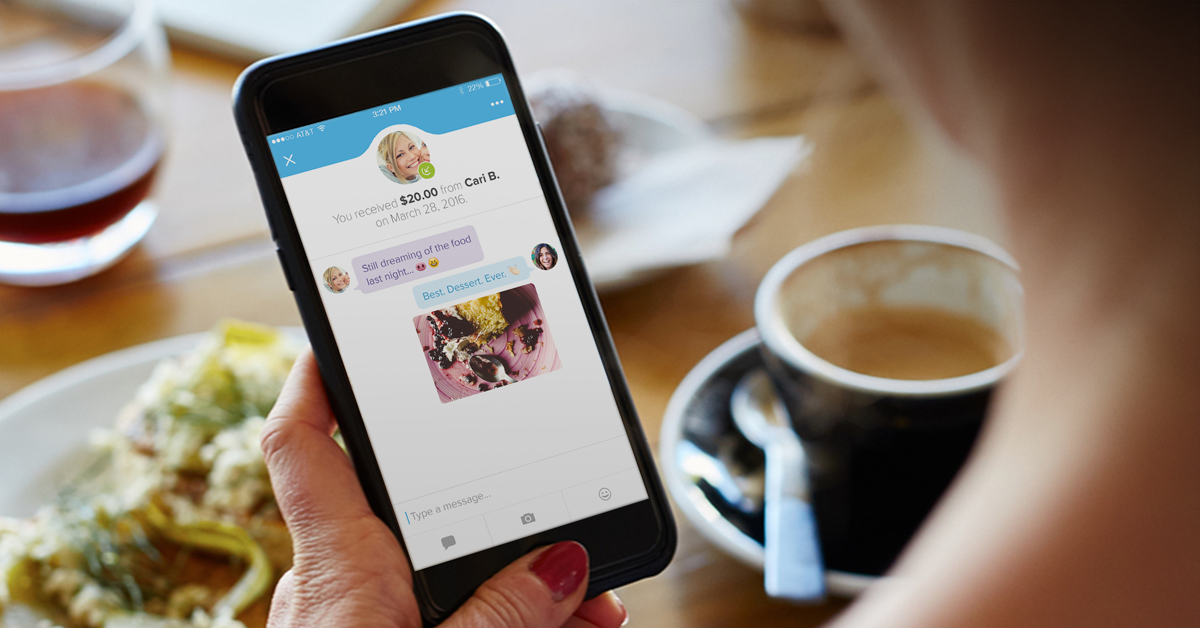

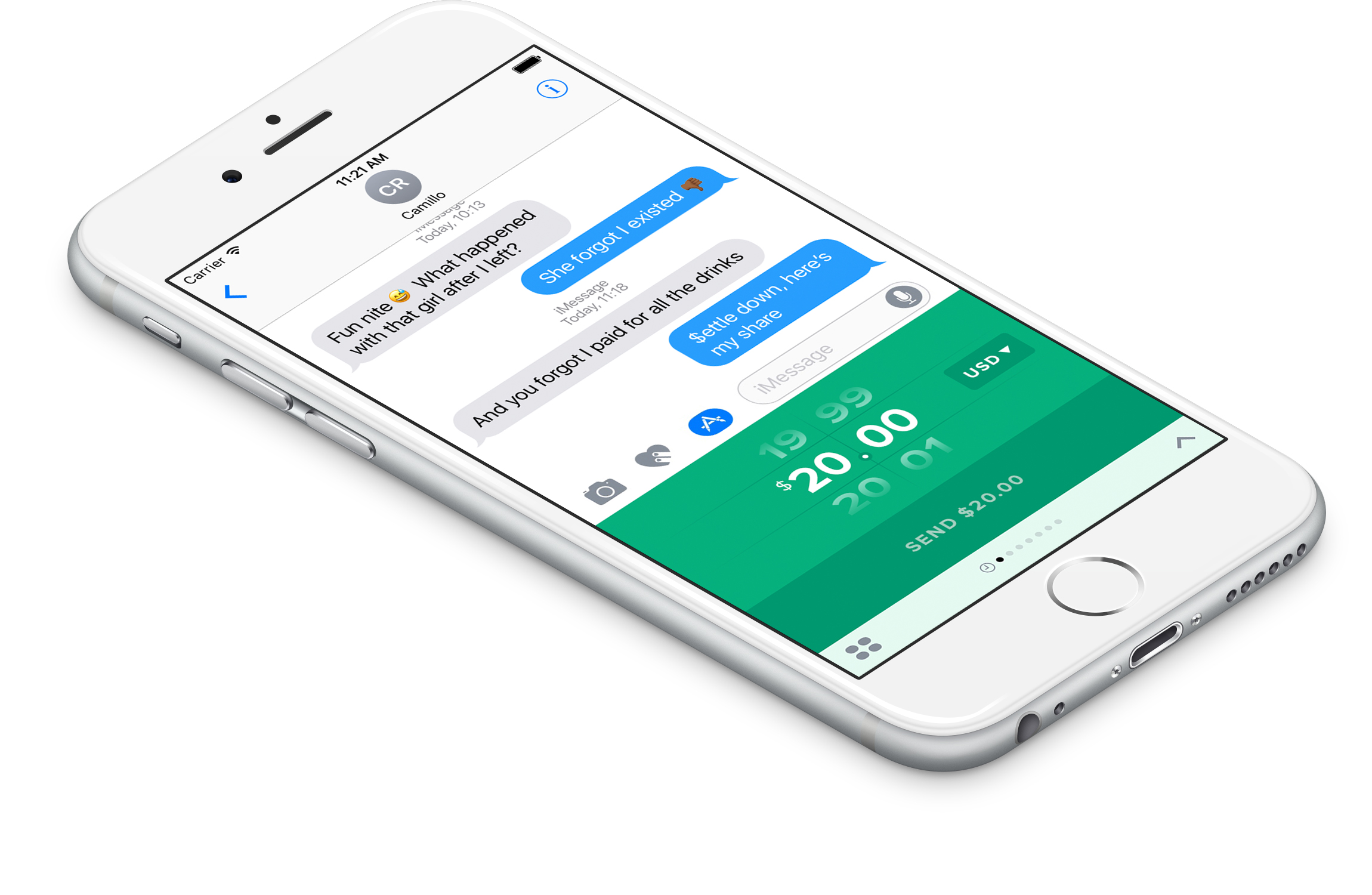

Could you imagine life without your smartphone and all the apps that come along with it? In seconds, Millennials can repay their friends for a cup of coffee with Circle app, in minutes they can have a car outside their front door with Uber, and overnight a package waiting on their doorstep with Amazon Prime.

Millennials are accustomed to creating, receiving, and sharing everything effortlessly and fast, and money is no exception. These days, the Millennial relationship with money reflects the increasingly digital, social, and cashless world around them. The generation is changing the paradigm when it comes to thinking about, sharing, and managing money.

It should come at no surprise that more than 50% of Millennials say they haven’t been to a bank teller in over a year; 7% saying they’ve never made a deposit in person. Millennials no longer view their finances as physical assets, but digital ones. 1’s and 0’s hidden somewhere — safely, we hope — in the world wide web.

As the largest generation today, Millennials are at the forefront of a massive disruption which is changing the way people think about money. Unlike previous generations, they are not looking to banks to solve their financial problems, instead they are turning to internet companies. In fact, a study done by Viacom found that 71% of Millennials rather go to the bank than listen to what banks are saying. They want digital solutions to age-old finance problems. A recent survey conducted by Circle revealed that over half of Millennial respondents have 1-5 apps currently linked to bank accounts or credit cards. And in that same survey, twice as many Millennials said they carry no cash at all compared to their parents.

It’s clear that the transfer of money is changing. Millennials view their funds as a mode of transmission, like a conversation between two parties. You buy something, you pay for it. For Millennials, transferring money should be as easy as a text. Social payment apps like Circle are making that vision a reality. In fact, it’s not crazy to imagine a future where all of a person’s financial needs can be conducted through a messaging app.

But it’s not just payments that are changing. The way people save, invest, and even plan for retirement is due for major change and Millennials will be the first generation to navigate this new digital future of finance. But don’t sweat it Millennials, you are not alone.

But it’s not just payments that are changing. The way people save, invest, and even plan for retirement is due for major change and Millennials will be the first generation to navigate this new digital future of finance. But don’t sweat it Millennials, you are not alone.

Check out the Young Money Guide! To learn more about Circle, visit www.circle.com/en. Download the app, available for Apple and Android users!

SHARE

READ & LEAVE A COMMENT